Mexican banks' CET1 ratios improve in Q4'19 as Brazilian lenders underperform | S&P Global Market Intelligence

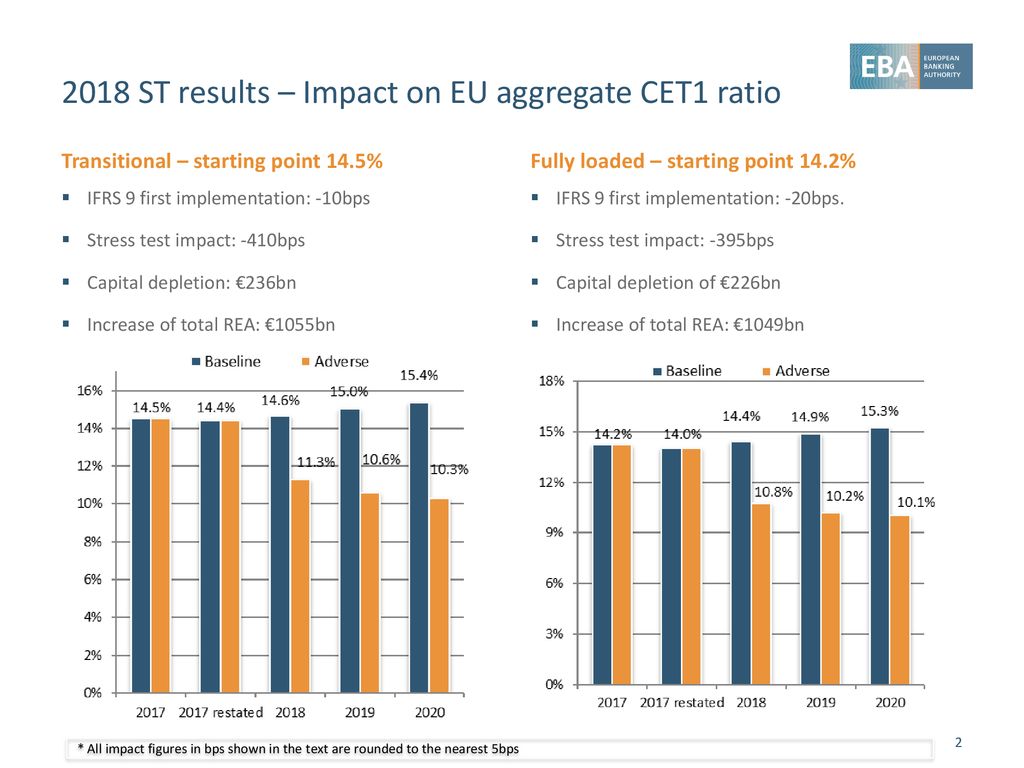

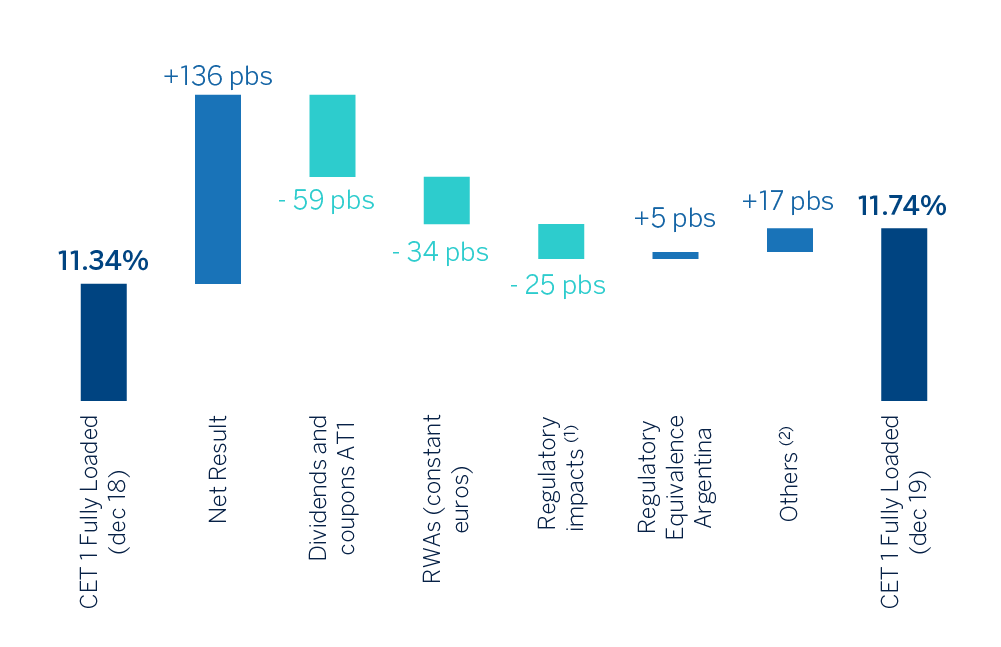

Banco Santander: A 5.5B EUR Capital Deficit In The Stress Test Adverse Scenario Isn't A Big Issue (NYSE:SAN) | Seeking Alpha

Capital Markets Day 2017 CFO Speech Slide 2 – One Bank, One UniCredit / The five pillars Thank you TJ, and good morning everyo

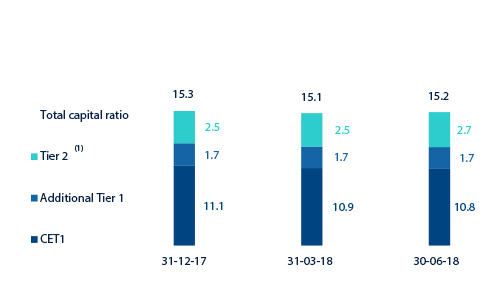

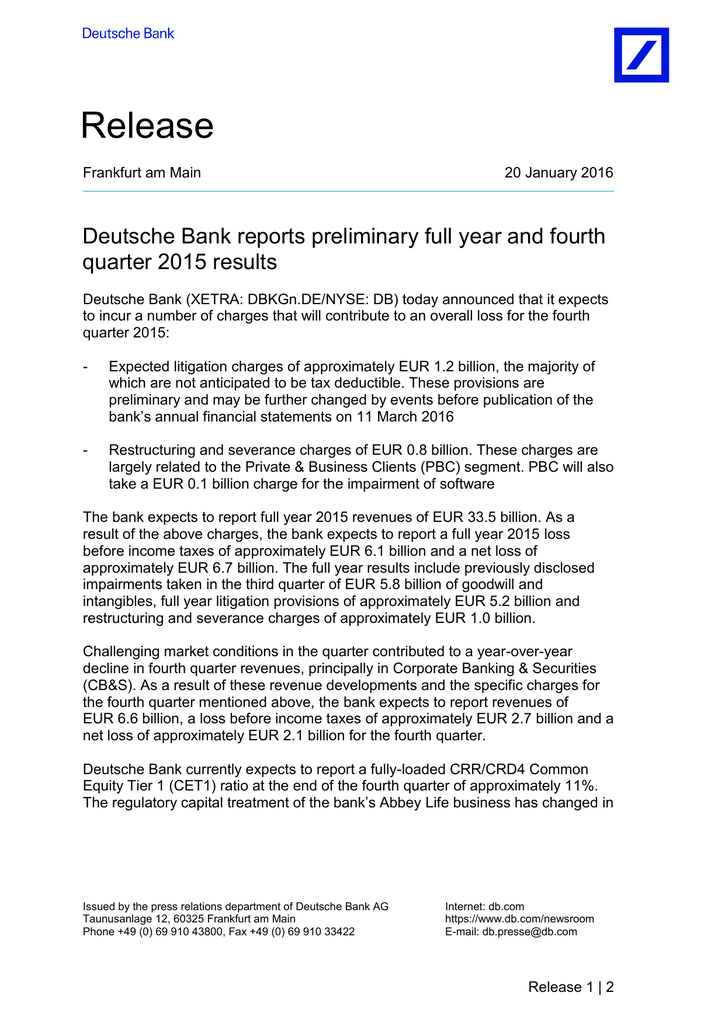

The solvency of European Union banks continues to improve-european union-economic research-bnp paribas

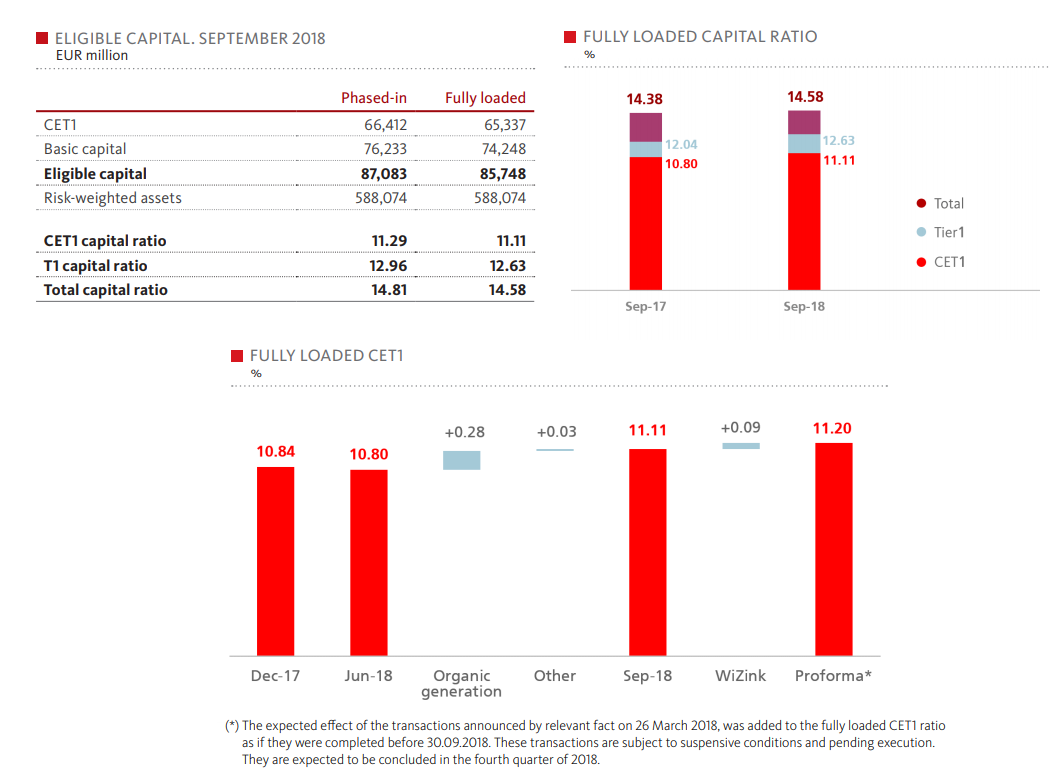

la Caixa Group passes the ECB Comprehensive Assessment with a CET1 ratio of 9.3% under the adverse scenario, while CaixaBank would achieve 10.3%

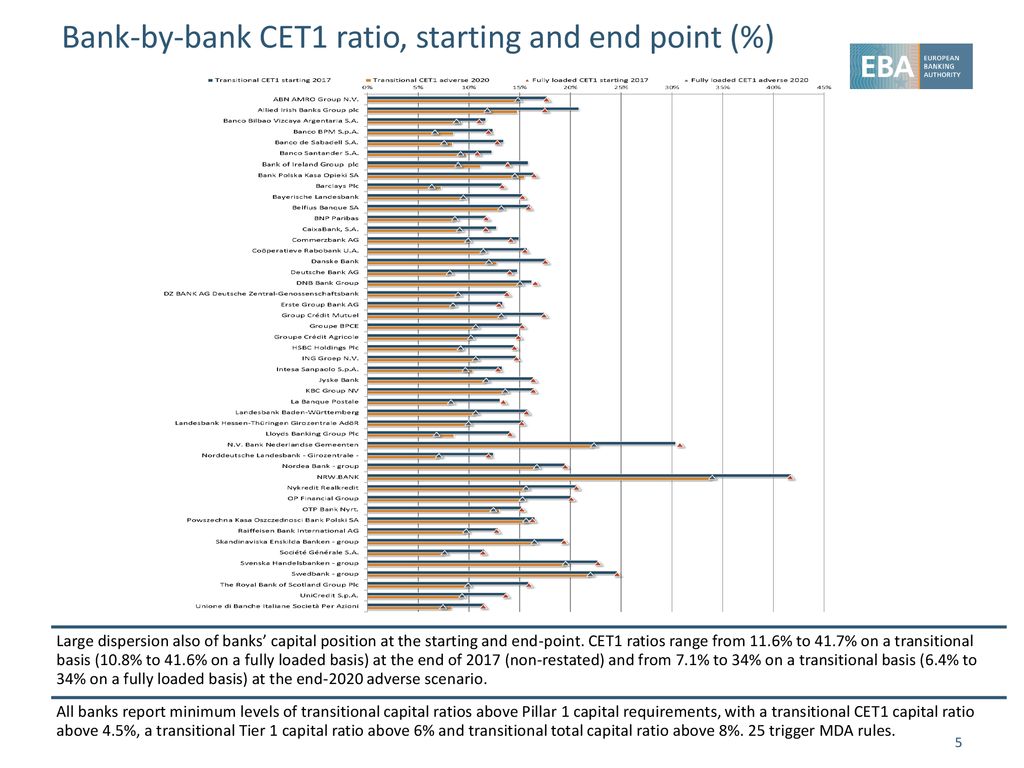

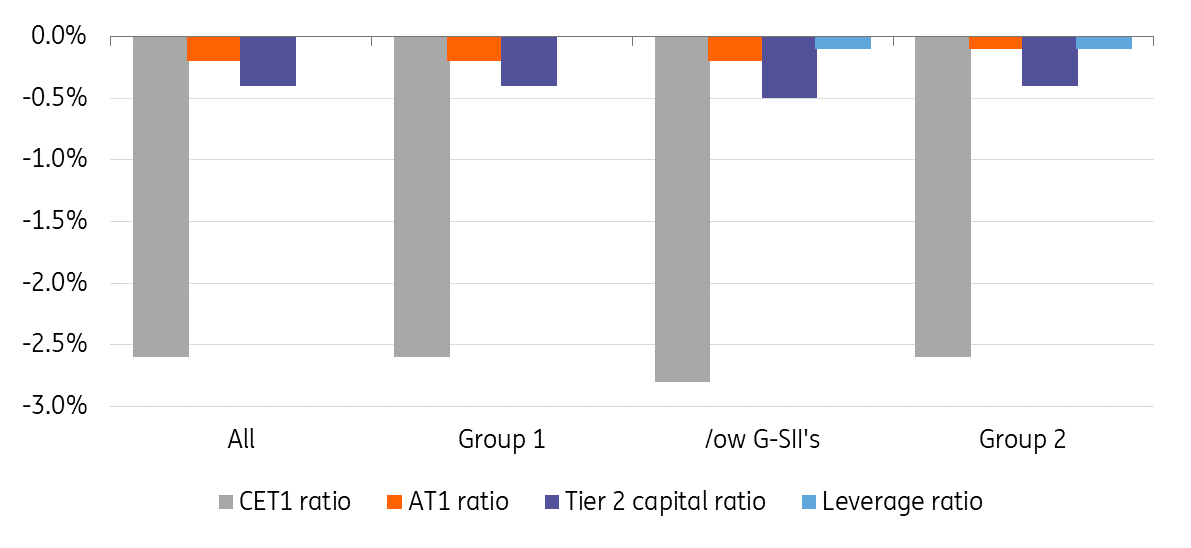

EBA publishes the results of its 2021 EU-wide stress test | EBA publishes the results of its 2021 EU-wide stress test | Better Regulation

Bank Pulse: Full Basel reforms to further increase European banks' capital requirements | Article | ING Think